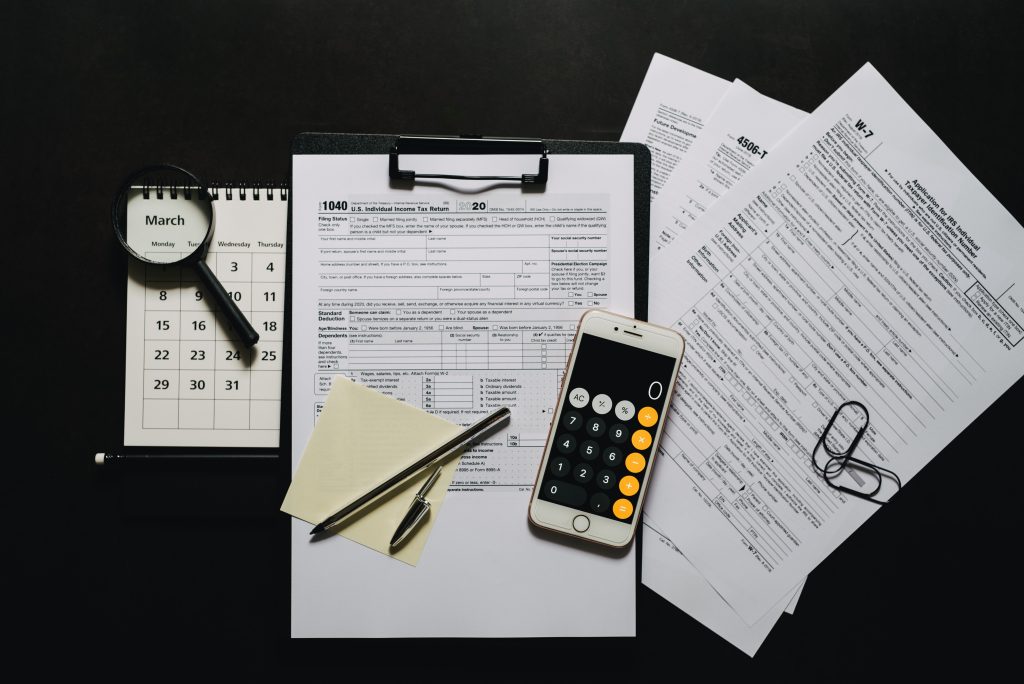

If you opted to file an extension this year, you’re in good company. Taking a tax extension can be a wise move, giving us the extra breathing room we sometimes need. They can also provide clarity, ensuring that no stone is left unturned in your filing. And now, as that extended deadline creeps closer, let’s get ready and make sure you have everything in place to make the filing process smooth and error-free.

Document Gathering: Beyond the Basics

First things first: Paperwork. Got a mountain of it? Let’s sort it out. Maybe you’re an old-school binder person or maybe you’ve traded the binders for QuickBooks. Either way, having all your documents in order can make this whole tax thing way less of a headache. Plus, nothing beats the peace of mind that comes from knowing you’ve checked and double checked.

Income Streams: W2s are the usual suspects, but in this gig economy? We’ve all got those side hustles, freelance gigs, and maybe even some passive income rolling in. Every stream of income contributes to your overall financial situation, so make sure you document each and every one.

Deductions and Credits: Ever look at your expenses and think, “Where did my money go?” Well, some of those might be deductible. Tuition fees, medical costs, donations – the year’s full of expenses. And hey, even that makeshift home office might get you some credit. Keep an eye out because credits and deductions can really help you out.

Investments: Whether you’ve played it safe with bonds or taken a leap with stocks, your investments are a big piece of the pie. They shape your financial journey and keeping them in check can lead to some pleasant surprises. Remember, knowledge is power – especially with investments.

Life Changes and Their Tax Implications

Life’s a roller coaster, full of twists and turns. And sometimes, they change the way you file your taxes.

Relocation: New place? Moving can have a big impact on your taxes, especially if you’ve moved to a different state. You should take some time to familiarize yourself with any state-specific tax regulations.

Marital Bliss: If wedding bells rang this year, you’ve got some decisions to make. To file together or keep things separate? This could mean some big changes in how you handle your taxes.

Growing Family: Little one on the way or just arrived? Along with the joy (and yes, sleepless nights), there may be some benefits to explore. Little feet bring big joys, and sometimes, tax breaks!

Digital Advantage

Digital tools can help streamline and simplify the tax filing process.

Tax Software: Modern tax software does more than just provide a digital interface; it offers guidance, reminders, and useful insights that can minimize errors and enhance your understanding.

Expense Trackers: Remember that coffee machine subscription or that monthly charity donation? Having an app that tracks those can be super handy when you’re crunching numbers. It’s the little expenses that often slip through the cracks – but not anymore!

The Benefits of Professional Input

Sometimes, two heads are better than one, especially when one’s a tax professional.

Tax Consultants: They’re the tax whisperers. They spot things you might miss and can be the voice of reason in the haze of numbers.

Audit Assistance: If the IRS raises an eyebrow, having an expert by your side can be a game-changer. It’s like having a buddy in the tax world. When things get tricky, it’s good to have a friend to lean on.

Looking Back to Move Forward

Before diving deep, take a sec to look back. Did you switch jobs? Maybe you took some time off? These bits and pieces of your year play into your tax story. They form the chapters of your year-long narrative.

FileSmart: Convenient Expertise

As a FileSmart member, you not only you get access to an intuitive platform full of tax resources and educational materials, you also get access to real tax professionals. With the ability to ask up to 5 questions every month, it’s like having a tax advisor in your pocket. We’re dedicated to providing expert guidance you can count on in an easy-to-navigate format.

Closing Thoughts

Tackling taxes, especially after an extension, can feel like climbing a mountain. But remember, every document gathered, every form filled, and every question answered is a step closer to the summit. The path might be steep, but the view (and sense of relief) at the top is worth every step. And with tools and resources like FileSmart, you’re not climbing alone.

Here’s to wrapping up this tax season with flair and gearing up for the next. Let’s keep moving forward, one step at a time – happy filing!

0