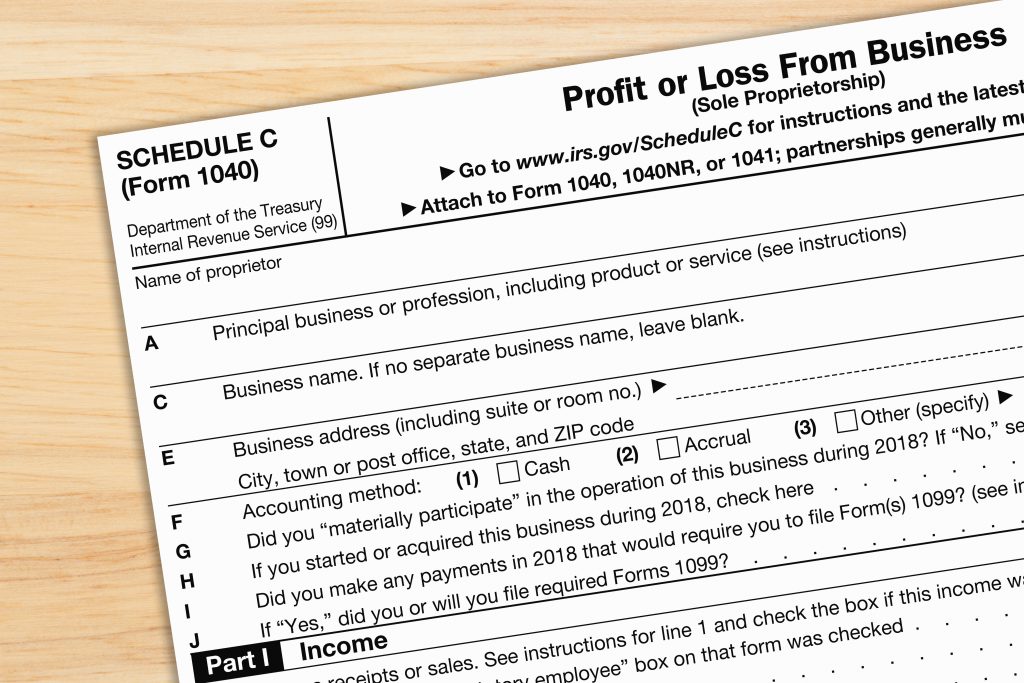

First of all, cheers to you for stepping into the self-employment world! It’s a great journey filled with freedom, creativity, and… taxes? Yep, you heard that right. And speaking of taxes, have you met our dear friend, Schedule C? If not, let me introduce you. Schedule C is your new companion as a self-employed individual – think of it as a bridge between you and the IRS. It’s the tax form where you report income or loss from your business. And you thought building the business was the hard part, eh? Well, don’t worry, we’ve got your back!

The Basics

The name “Schedule C” sounds pretty ominous, doesn’t it? But let’s demystify it. It’s simply a tax form that you, as a self-employed person or a small business owner, must use to report your income or loss from your business ventures. Think freelancers, contractors, sole proprietors – the whole gang. If your fingers are doing the walking and your mind is doing the talking in a business operation, chances are you’ll be dealing with a Schedule C.

Now, this Schedule C isn’t an island. It doesn’t just stand alone. It’s part of your overall tax return, Form 1040. It’s where you explain how your business did during the year. Kind of like a report card for your business, except instead of grades, you have profits (and sometimes losses).

Components of Schedule C

Now, let’s open this Pandora’s box. Schedule C might look like a lot with its different parts and lines. But don’t worry, we’re in this together:

Part I: Income: This is where you tell the IRS how much your business made. It’s not just sales; it also includes returns, allowances, and any other income like interest on business checking accounts.

Part II: Expenses: Here’s where you get to tell the IRS about your costs of doing business – anything from advertising to utilities. It’s crucial to keep good records because these expenses offset your income and can reduce how much tax you owe. Sweet deal, huh?

Part III: Cost of Goods Sold: If you’re selling goods or products, this section is for you. It helps determine how much money you spent to make or buy the things you sold during the year.

Parts IV and V: Information on Your Vehicle and Other Expenses: If you use your vehicle for business purposes or have any other miscellaneous expenses, these sections have you covered.

Schedule C-EZ: The Lighter Load

If your business is super simple (no employees, no home office, no inventory), you might be able to file a Schedule C-EZ instead. It’s the “light” version of the Schedule C – fewer lines and less complexity. Ah, if only all of life could have an EZ version!

10 Common Mistakes to Avoid When Filing Schedule C

We all trip and stumble sometimes, even when filing taxes. But here are ten common missteps you’ll want to avoid:

1. Incorrectly reporting income: Remember, all income is not just sales! Don’t forget to include things like interest or other income.

2. Overlooking eligible deductions: Every expense that’s ordinary and necessary for your business is potentially deductible. Don’t leave money on the table!

3. Not keeping good records: Keep track of all those receipts, invoices, and bank statements. They’re your defense if the IRS ever questions your return.

4. Mixing personal and business expenses: Keep ’em separate; it can save you a lot of headaches.

5. Neglecting to include Cost of Goods Sold: If you sell goods, don’t forget about this crucial part. It can significantly reduce your taxable income.

6. Incorrectly classifying employees and independent contractors: This can lead to significant penalties. When in doubt, check the IRS guidelines.

7. Failing to file Schedule C when required: If you made money in your business, you need to report it, even if it’s a small amount.

8. Not accurately reporting the business use of your home or car: If you use either for your business, you may be eligible for a deduction. But be careful, there are specific rules for this.

9. Making mathematical errors: We’re human. Double-check your math or use a software program that does it for you.

10. Not seeking professional help when you need it: If you’re unsure about anything, don’t hesitate to ask for help. Tax pros exist for a reason!

Tips to Make Filing Schedule C Easier

Taxes aren’t anyone’s idea of fun, but there are a few things that can make dealing with Schedule C easier:

Keep good records. This cannot be stressed enough. Having a system to track your income and expenses throughout the year will make tax time less of a pain. There are several apps or software that can help with this.

And if taxes just aren’t your thing, consider getting help. Enter FileSmart: as a FileSmart member, you don’t just get help, but a full-on, tax-savvy friend. You’ll have access to courses to make tax lingo less confusing, and you can ask up to five tax questions each month to professionals. It’s like having a personal tax advisor, without the hefty price tag of a CPA.

Wrapping It Up

There you have it – a crash course on our friend, Schedule C! It might seem intimidating at first, but once you break it down, it’s not so scary. Remember, knowledge is power, and understanding your taxes gives you the power to take control of your business finances. And you’re not alone in this. There are great resources out there like FileSmart to keep your tax game strong and support you when you need help.

0