The Child Tax Credit (“CTC”) is a valuable resource for parents of children under the age of 17 who qualify. The credit is worth a maximum of $2,000 per child, $1,500 of which can be claimed as a refund.

Keep reading to see if you qualify for the credit and how much you can claim.

What is the Child Tax Credit?

The CTC was enacted in 1997 to help American families manage the costs associated with raising children. The credit gives taxpayers who have children under the age of 17 (and otherwise qualify) a break on their taxes each year.

The value of the credit has changed several times since 1997. In 2023, the maximum credit is worth up to $2,000 per qualifying dependent.

What Are The Requirements?

Many people assume that as long as you have children under the age of 17, you qualify for the CTC. However, there are several other requirements that you must meet to qualify. These include:

- Age – Your child must be under the age of 17 at the end of the tax year. If your child turns 17 before December 31st, you do not qualify.

- Income – To receive the full CTC, your modified adjusted gross income (“MAGI”) must be $200,000 or less as a single filer or $400,000 as a joint filer. The credit value is reduced by $50 for each $1,000 a taxpayer makes over the aforementioned limits.

- Relationship – The child that you are claiming as a dependent must be one of the following:

- Son or daughter

- Stepchild

- Foster child

- Brother or sister

- Half-brother or sister

- Stepbrother or sister

- Descendant of any of the above

- Dependent status – Your child must fall under the IRS definition of a dependent and be properly claimed as a dependent on your tax return.

- Residency – The dependent must live with you for at least half of the tax year. There are some exemptions for divorced parents and other special circumstances.

- Citizenship – In order to qualify, your child must be a U.S. citizen, U.S. national, or U.S. resident alien and have a valid social security number.

- Financial support- Your dependent must have provided no more than half of their own financial support during the year.

How Do I Claim the Child Tax Credit?

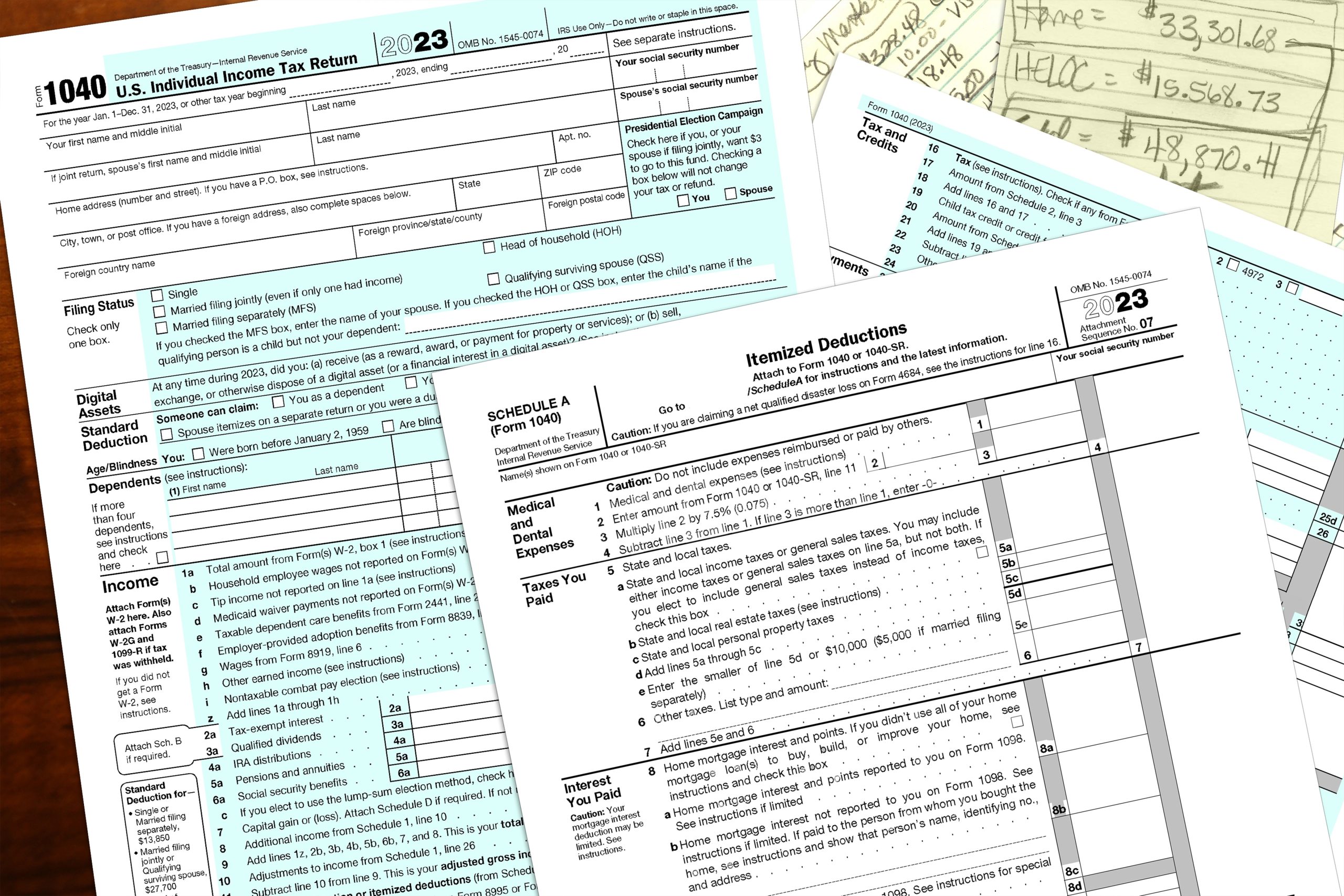

You will be able to claim the CTC when you complete your Form 1040 or 1040-SR. In addition, you should complete Schedule 8812 (Credits for Qualifying Children and Other Dependents), which you will attach and submit with your Form 1040.

Schedule 8812 helps you calculate your tax credit amount and how much you can claim as a refund, if applicable. In order to avoid making any mistakes when calculating this credit, we recommend using FileSmart’s tax-filing software, which helps take any guesswork out of calculating the tax credits you’re eligible for.

Is the Child Tax Credit Refundable?

Up to $1,500 of the CTC is refundable. That means that if the amount of the credit exceeds your tax liability (i.e., what you owe in taxes), then you will get money back on your tax return.

Is the CTC Still Higher than Normal Under the American Rescue Plan Act?

In 2021, in an attempt to combat the financial impacts of the COVID-19 pandemic, the CTC was raised to a maximum of $3,600 for children under 6 and $3,000 for children ages 6 to 17 as part of the American Rescue Plan Act (“ARPA”). Unfortunately, the ARPA has since expired, and the CTC has reverted to its pre-COVID levels.

What If I Don’t Qualify for the Child Tax Credit?

If you don’t qualify for the CTC, you may qualify for the Credit for Other Dependents. Thankfully, this credit can be claimed in addition to the Child and Dependent Care Credit and the Earned Income Credit. However, the Credit for Other Dependents is only worth up to a maximum of $500 for each dependent.

You can visit the IRS website to see if you meet the qualifications for the Credit for Other Dependents.

What if I Make an Error Calculating the Child Tax Credit?

It is essential to ensure that you actually qualify for the CTC and calculate your credit accurately. In addition to potentially delaying your tax return, a miscalculation of the CTC can result in you having to pay back the credit, plus interest and potential penalties.

In order to avoid making costly errors calculating the CTC or on your tax return in general, you can become a FileSmart member. Our tax filing software helps ensure that all of your calculations are accurate. In addition, our team of tax experts can help answer your questions throughout the year to ensure you get all of the tax credits you’re eligible for. (You can ask our tax experts up to 5 questions/month, for a fraction of the price of hiring a CPA.) Sign up for FileSmart here.

0