Income taxes may be the last thing you want to think about. After all, no one likes seeing a huge portion of their paycheck automatically subtracted before the money even gets deposited in their bank account.

However, knowing how income taxes work could save you a ton of money come tax time and throughout the year.

In this article, we’ll teach you everything you need to know about income taxes, so you can save more money.

What is Income Tax?

Income tax is the tax that the federal, and sometimes state and local, government collects on businesses and individuals’ earned money. The amount that the government collects on this income varies based on how much money is made throughout the year.

According to Statista, the federal government collected $2.63 trillion dollars of income tax in 2022. That’s over half of the total government revenue of $4.89 trillion.

Income tax plays a huge part in the operating budget of the US government. This money goes towards paying for public services like the military, transportation, research, and education.

How Does Income Tax Work?

If you work for an employer, taxes are typically taken out of your paycheck at a predetermined rate before the money even hits your bank account. In order to understand how this tax rate is calculated, it’s first important to understand how the income tax system works.

The Federal government charges taxes on a marginal and progressive basis, but what does that mean in plain English?

- Progressive – a progressive tax system just means that the more taxable income you make, the higher percentage you’ll pay in taxes.

- Marginal – each tax rate only applies to a portion of your income. For example, if you are a single-filer in 2023, the first $11,000 of your income, regardless of how much you make, is taxed at 10%.

Keeping that in mind, let’s look at the income tax table for 2023.

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns | For Heads of Households |

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $15,700 |

| 12% | $11,000 to $44,725 | $22,000 to $89,450 | $15,700 to $59,850 |

| 22% | $44,725 to $95,375 | $89,450 to $190,750 | $59,850 to $95,350 |

| 24% | $95,375 to $182,100 | $190,750 to $364,200 | $95,350 to $182,100 |

| 32% | $182,100 to $231,250 | $364,200 to $462,500 | $182,100 to $231,250 |

| 35% | $231,250 to $578,125 | $462,500 to $693,750 | $231,250 to $578,100 |

| 37% | $578,125 or more | $693,750 or more | $578,100 or more |

How Do I Calculate Income Tax?

If you have an annual salary or know exactly how much you’ll make in taxable income each year, then calculating your income tax is fairly simple! All you need to do is determine your effective tax rate, which is the average rate that you’ll pay on all income throughout a tax year.

Your effective tax rate is the rate that your employer uses to take tax deductions out of each paycheck. Check out our post on how to calculate income tax owed if you want to learn more about determining how much you’ll pay in income taxes each year.

What are the Types of Income Tax?

Thus far, this article has focused mostly on individual federal income tax; however, depending on where you live, you may be subject to state and local income taxes as well. In addition, businesses pay income taxes differently than individuals do.

Individual Income Tax

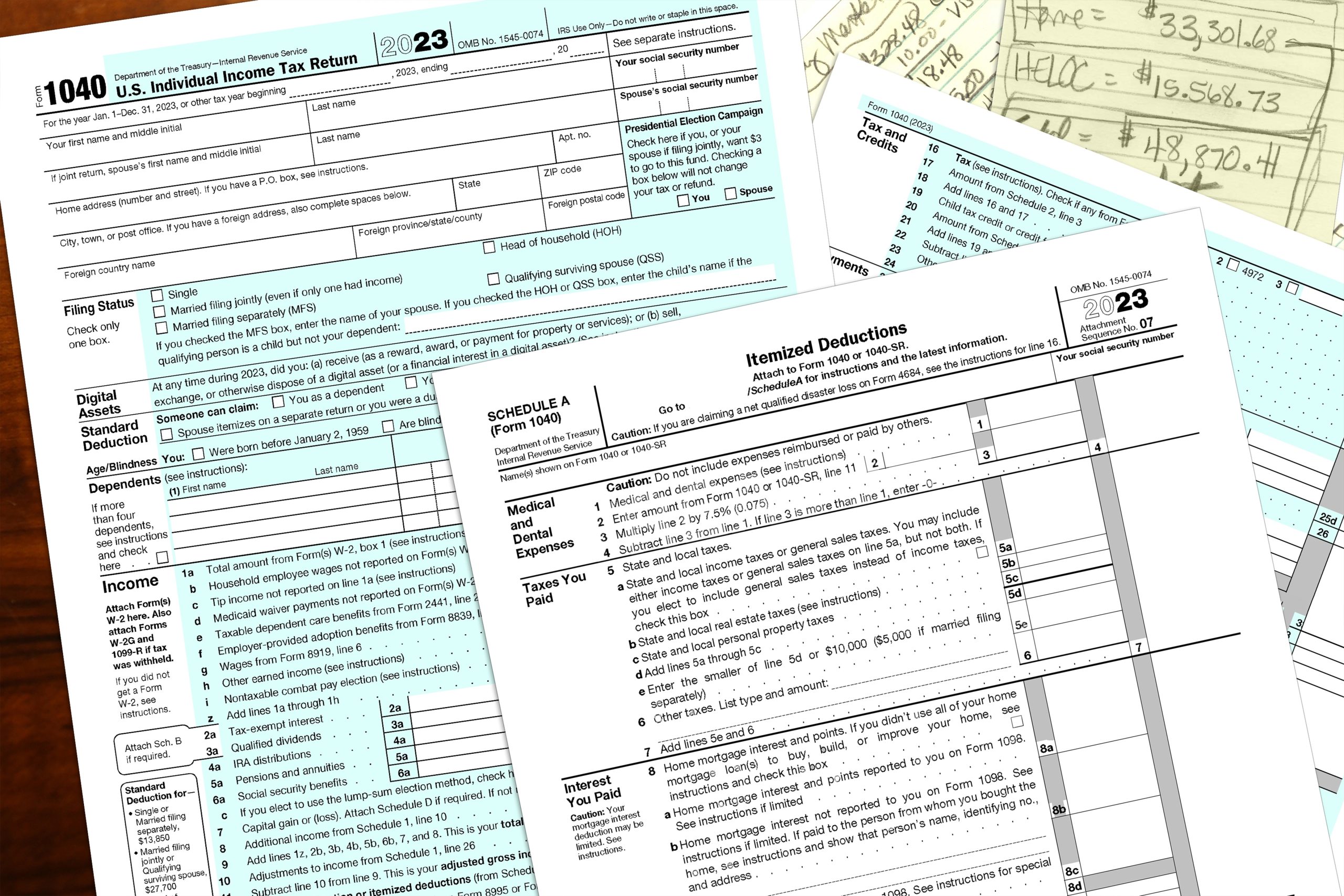

One of the most widely-known types of income tax is the individual federal income tax. If you’re earning money in the US, then chances are you’re required to pay federal income taxes. However, not all income is subject to taxes.

In addition, tax credits and deductions allow American taxpayers to “exclude” some of their earned income from being taxed. Credits and deductions are set by the government and are usually a way to incentivize people to buy into programs and policies that are a priority at the time.

Business Income Tax

Businesses and corporations also are subject to taxes on their earnings. The way a business is taxed depends on how it’s incorporated, but as a general rule, businesses are taxed on the difference between their income and operating and capital expenses.

State and Local Income Taxes

Most states in the US have some form of income tax on top of federal income tax. States don’t charge the same tax rate or necessarily even use the same tax system as the federal government. There are three different approaches to state income tax:

- Progressive income tax

- Flat income tax

- No income tax

Most states (32 as of publishing) use a progressive income tax system. This works just like the federal income tax system, where individuals that earn more taxable income pay more than those who don’t. The only difference is that the tax rates are usually much lower than federal taxes.

Some states charge a flat tax. In these states, every citizen is charged the same rate regardless of income. The states that use this structure include:

- Colorado

- Illinois

- Indiana

- Kentucky

- Massachusetts

- Michigan

- North Carolina

- Pennsylvania

- Utah

Finally, some states don’t charge income tax at all. The states that have no income tax include:

- Alaska

- Florida

- New Hampshire

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

In addition to state income taxes, some local municipalities and counties charge income tax on top of state income tax. While paying a high state or local income tax may seem like a burden, every state finds a way to collect taxes in some form. Therefore, you should understand the whole tax situation of a state before packing up and moving just to save money on taxes.

Saving Money on Income Taxes

The best way to save money on income taxes isn’t always clear. That’s why having tax experts in your back pocket is one of the best ways to save money. As a FileSmart member, you can ask our team of tax experts up to five questions each month to get the best advice on setting yourself up for success when it comes to income taxes. Sign up for FileSmart today to start saving!

0